Sitharaman presents Budget amid applause; tax relief draws loudest cheer

No tax on income up to Rs 7 Lakh, standard deduction allowed under new tax regime

02/02/2023

NEW DELHI, Feb 1: Finance Minister Nirmala Sitharaman's Budget speech on Wednesday was marked by the usual thumping of benches by the ruling alliance members, but the loudest cheer was reserved for her announcement of income tax relief, which was welcomed by "Modi, Modi" chants in Lok Sabha that also witnessed a few instances of protest by the Opposition.

Sitharaman's follow-up state-ment that the tax relief will only be available to those opting for the new regime might have dampened spirits, but another round of applause from the treasury benches came when she announced a massive 33 per cent hike in the capital expenditure to Rs 10 lakh crore.

The treasury benches frequently broke into chants of "Modi Modi".

Congress members welcomed their former president Rahul Gandhi with the slogan of 'Jodo, Jodo, Bharat Jodo' when he entered Lok Sabha a few minutes after Sitharaman had started her speech.

Some Opposition voices also shouted "Adani Adani", a reference to the controversy following an adverse report from a short-selling firm against the corporate czar's conglomerate.

Many ministers, some tightly squeezed into their seats to accommodate others as the ruling alliance members were present in the full strength, and a few Opposition members were seen making notes during the speech.

If Gandhi was a few minutes late, actor-turned-politician Shatrughan Sinha, now a Trinamool Congress MP, arrived over 50 minutes later.

The one opposition member who rose a few times to lodge protest was Adhir Ranjan Chowdhury, the Leader of the Congress in the House. However, his lone voice was often drowned out by the treasure benches as the finance minister continued her speech.

The Lok Sabha chamber witnessed camaraderie before the House assembled for the day with National Conference members Farooq Abdullah and Hasnain Masoodi having a chat with Home Minister Amit Shah.

Sitharaman was wearing a red Pochampally saree with a black border, a weave of Telangana, with kasuti embroidery which is a speciality of Karnataka, the state she represents in the Rajya Sabha.

She was welcomed with a huge round of applause by the treasury benches and was seen taking out her tablet PC from the red coloured bahi-khata pouch with a golden coloured national emblem on it.

Prime Minister Narendra Modi walked in shortly before 11:00 am, welcomed by the chants of 'Bharat Mata ki Jai'.

Soon after, Congress Parliamentary Party chief Sonia Gandhi, draped in a black saree with pink border, walked in the House with deputy leader Gaurav Gogoi in tow.

A bearded Rahul Gandhi entered the Lok Sabha with Congress members chanting Jodo, Jodo, Bharat Jodo' after Sitharaman.

The Congress members' action left several ministers and BJP members visibly irritated, but Sitharaman continued with her speech calmly.

Trinamool Congress members, who leave no opportunity to take potshots at the government, were unusually quiet throughout the presentation of the Budget, except for a stray remark from veteran member Saugata Ray.

The Prime Minister was seen thumping his desk when Sithraman referred to millets as 'Shri Anna'. However, the opposition members were amused at the reference and a section likened it to 'Anna' (elder brother).

Sitharaman's announcement of allocation of Rs 5,300 crore to the Upper Bhadra project in Karnataka was described as a sop for the state where elections are due in May.

The announcement of building 50 new regional airports had the opposition breaking into chants of Adani, Adani', an apparent reference to the Adani Group which had won the mandate to operate seven of the eight airports leased by the Airports Authority of India.

Congress leader Adhir Ranjan Chowdhury asked loudly if the government plans to reduce the prices of petroleum products, when the Finance Minister mentioned the Green Hydrogen Mission.

NCP member Srinivas Patil was seen clicking pictures of the Treasury Benches inside Lok Sabha.

The prime minister walked up to Sitharaman to congratulate her after she presented the Budget. The Finance Minister was surrounded by her ministerial colleagues as well as some members of the Opposition.

Sitharaman's daughter and relatives were present in the Speaker's Gallery of Lok Sabha during the Budget presentation.

Several Rajya Sabha members, including Deputy Chairman Harivansh, BJP member Dhananjay Mahadik, Congress member Amee Yagnik were present in the gallery meant for members of the Upper House.

Sitharaman tweaked the slabs to provide some relief to the middle class by announcing that no tax would be levied on annual income of up to Rs 7 lakh under the new tax regime.

She also allowed a Rs 50,000 standard deduction to taxpayers under the new regime, where assessees cannot claim deductions or exemptions on their investments.

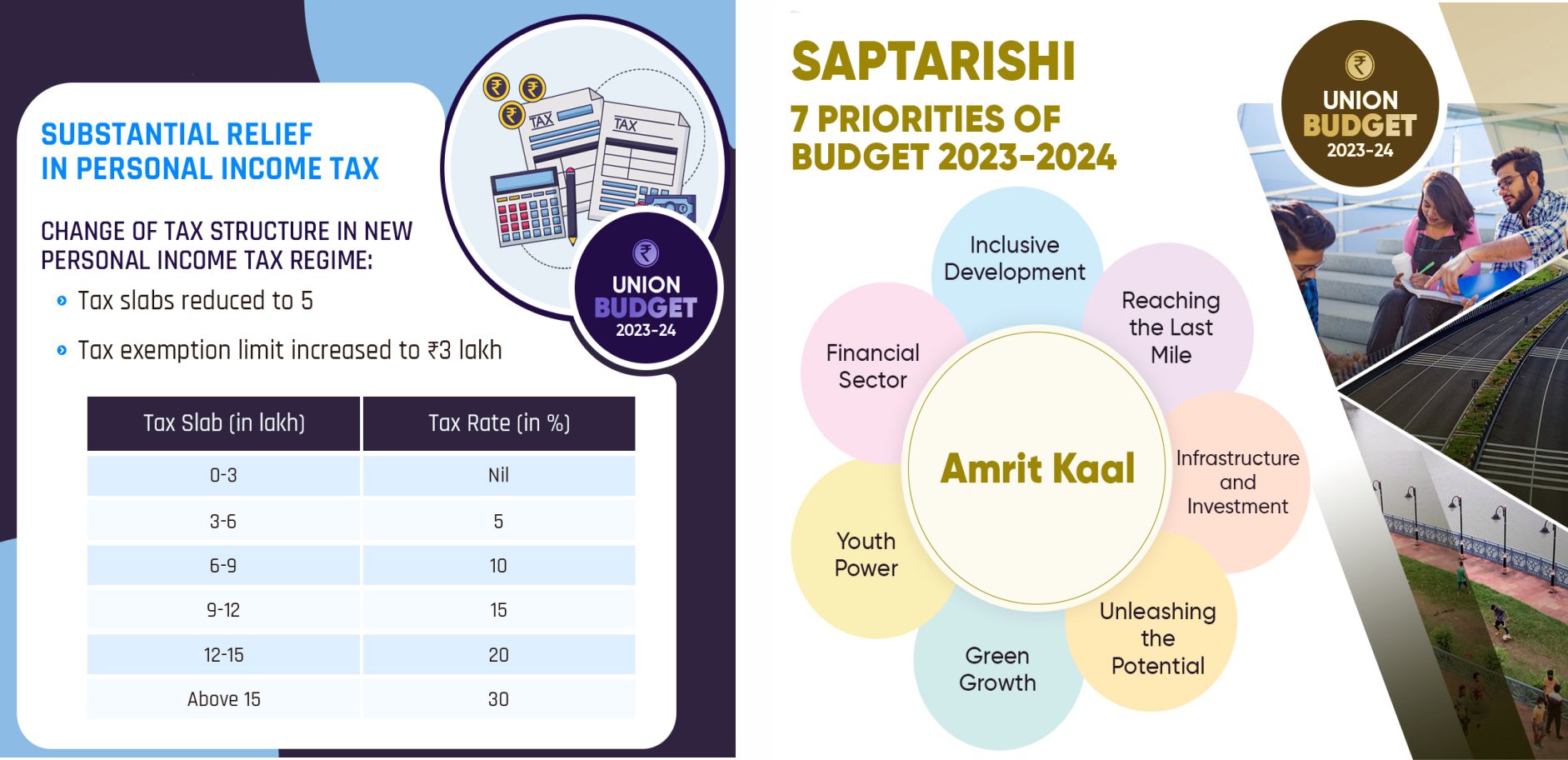

She also tweaked the concessional tax regime, which was originally introduced in 2020-21, by hiking the tax exemption limit by Rs 50,000 to Rs 3 lakh and reducing the number of slabs to five.

In the Budget for 2023-24, Sitharaman said currently individuals with total income of up to Rs 5 lakh do not pay any tax due to rebate under both the old and new regimes.

“It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to Rs 7 lakh,” Sitharaman said.

She further said under the new personal income tax regime, the number of slabs would be reduced to five.

“I propose to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs 3 lakh,” Sitharaman said.

Under the revamped concessional tax regime, no tax would be levied for income up to Rs 3 lakh. Income between Rs 3-6 lakh would be taxed at 5 per cent; Rs 6-9 lakh at 10 per cent, Rs 9-12 lakh at 15 per cent, Rs 12-15 lakh at 20 per cent and income of Rs 15 lakh and above will be taxed at 30 per cent.

“I propose to extend the benefit of standard deduction to the new tax regime. Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500,” Sitharaman said

The government in Budget 2020-21 brought in an optional income tax regime, under which individuals and Hindu Undivided Families (HUFs) were to be taxed at lower rates if they did not avail specified exemptions and deductions, like house rent allowance (HRA), interest on home loan, investments made under Section 80C, 80D and 80CCD. Under this, total income up to Rs 2.5 lakh was tax exempt.

Currently, a 5 per cent tax is levied on total income between Rs 2.5 lakh and Rs 5 lakh, 10 per cent on Rs 5 lakh to Rs 7.5 lakh, 15 per cent on Rs 7.5 lakh to Rs 10 lakh, 20 per cent on Rs 10 lakh to Rs 12.5 lakh, 25 per cent on Rs 12.5 lakh to Rs 15 lakh, and 30 per cent on above Rs 15 lakh.

The scheme, however, has not gained traction as in several cases it resulted in higher tax burden.

With effect from April 1, these slabs will be modified as per the Budget announcement.

Share This Story |

|

Comment On This Story |

|

|

|

|